The 9-Minute Rule for Frost Pllc

The 9-Minute Rule for Frost Pllc

Blog Article

Rumored Buzz on Frost Pllc

Table of ContentsFrost Pllc Fundamentals ExplainedA Biased View of Frost PllcThe Single Strategy To Use For Frost PllcOur Frost Pllc StatementsWhat Does Frost Pllc Do?

CPAs are amongst one of the most relied on professions, and completely factor. Not just do CPAs bring an unequaled level of understanding, experience and education to the procedure of tax obligation preparation and handling your money, they are particularly trained to be independent and unbiased in their job. A certified public accountant will aid you protect your rate of interests, pay attention to and address your issues and, similarly crucial, provide you peace of mind.Working with a local Certified public accountant firm can favorably impact your service's monetary wellness and success. A regional Certified public accountant company can assist minimize your service's tax obligation problem while making sure compliance with all appropriate tax obligation laws.

This development mirrors our devotion to making a favorable impact in the lives of our clients. When you function with CMP, you come to be part of our family.

Not known Factual Statements About Frost Pllc

Jenifer Ogzewalla I have actually worked with CMP for several years now, and I've really appreciated their knowledge and effectiveness. When auditing, they work around my schedule, and do all they can to maintain connection of personnel on our audit. This saves me energy and time, which is invaluable to me. Charlotte Cantwell, Utah Festival Opera & Music Theater For a lot more motivating success tales and responses from local business owner, click right here and see how we've made a distinction for businesses like your own.

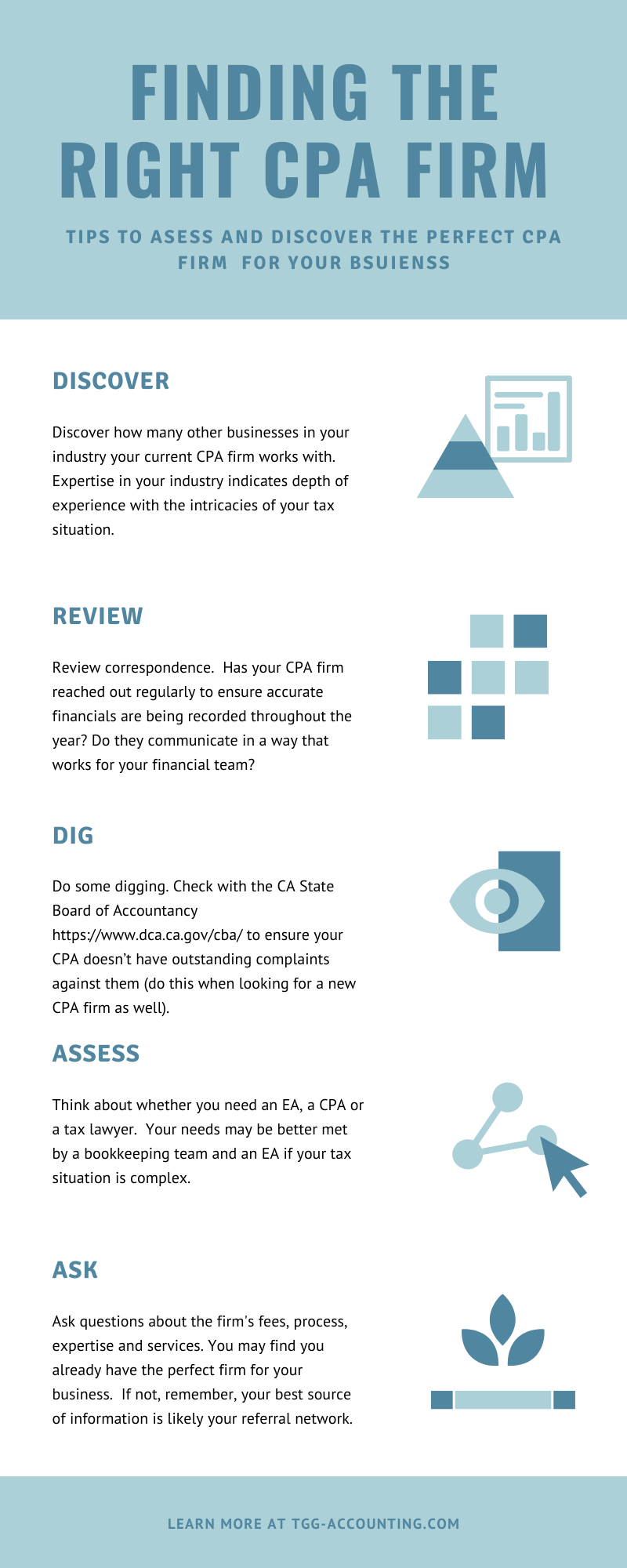

Below are some key concerns to lead your choice: Check if the CPA holds an active certificate. This ensures that they have passed the essential examinations and satisfy high moral and specialist criteria, and it reveals that they have the qualifications to handle your monetary issues sensibly. Verify if the certified public accountant provides services that straighten with your business demands.

Little services have one-of-a-kind financial requirements, and a CPA with appropriate experience can offer even more customized suggestions. Ask concerning their experience in your market or with businesses of your dimension to ensure they understand your certain obstacles.

Working with a neighborhood CPA company is even more than simply outsourcing financial tasksit's a smart financial investment in your service's future. go right here Certified public accountants are licensed, accounting professionals. CPAs may work for themselves or as part of a company, depending on the setup.

records to a firm that concentrates on this location, you not only free yourself from this time-consuming job, yet you also complimentary reference yourself from the threat of making blunders that can cost you economically. You might not be benefiting from all the tax financial savings and tax obligation deductions readily available to you. One of the most critical inquiry to ask is:'When you conserve, are you placing it where it can expand? '. Several organizations have actually applied cost-cutting measures to reduce their general expense, yet they have not place the cash where it can help the service grow. With the help of a CPA company, you can make the most enlightened choices and profit-making techniques, taking into consideration one of the most present, updated tax policies. Government companies whatsoever levels call for paperwork and conformity.

Some Known Facts About Frost Pllc.

Tackling this duty can be an overwhelming job, and doing something wrong can cost you both financially and reputationally (Frost PLLC). Full-service CPA companies recognize with filing demands to ensure your organization abide by government and state legislations, in addition to those of banks, financiers, and others. You may require to report added earnings, which might require you to file a tax obligation return for the very first time

CPAs are the" large guns "of the accounting industry and normally don't handle day-to-day accountancy tasks. Usually, these various other kinds of accounting professionals have specializeds throughout areas where having a CPA license isn't needed, such as management accountancy, nonprofit audit, expense accounting, federal government bookkeeping, or audit. As an outcome, utilizing a bookkeeping services company is usually a much better value than employing a CERTIFIED PUBLIC ACCOUNTANT

firm to support your sustain financial continuous effortsMonitoring

Certified public accountants likewise have competence in establishing and refining organizational plans and treatments and analysis of the useful needs of staffing models. A well-connected CPA can take advantage of their network to assist the organization in numerous tactical and consulting roles, successfully attaching the organization to the suitable prospect to meet their demands. Next time you're looking to fill Get More Info a board seat, think about reaching out to a CPA that can bring value to your company in all the methods detailed above.

Report this page